Why regulatory sandboxes matter for autonomous blockchain

Autonomous blockchain innovations move fast, regulators move slow, и бизнесы оказываются между ними. A regulatory sandbox is basically an official “safe zone” where you can test products with real users, under supervision, but with relaxed rules and negotiated limits. When we talk about a regulatory sandbox for blockchain startups, we mean a legal framework that lets teams experiment with smart contracts, DAOs, on‑chain governance and automated compliance without instantly triggering the full weight of securities, banking or payments law. Instead of asking for forgiveness later, the sandbox lets you ask for permission in advance — and get it in a more flexible, iterative way.

Key terms, without the legalese overload

Before going deeper, it helps to agree on vocabulary. A *regulatory sandbox* is a time‑limited, scope‑limited environment approved by a regulator where you can test products with waivers or tailored obligations. *Autonomous blockchain* usually refers to systems where smart contracts, oracles and governance logic run with minimal human intervention. *Autonomous blockchain compliance solutions* are architectures where obligations like KYC, transaction limits, or reporting are encoded in contracts and executed on-chain. Finally, *blockchain innovation licensing and regulatory sandbox* denotes situations where the sandbox is explicitly tied to a future license: if your experiment works and risks look manageable, you can transition to a full regulatory authorization more smoothly.

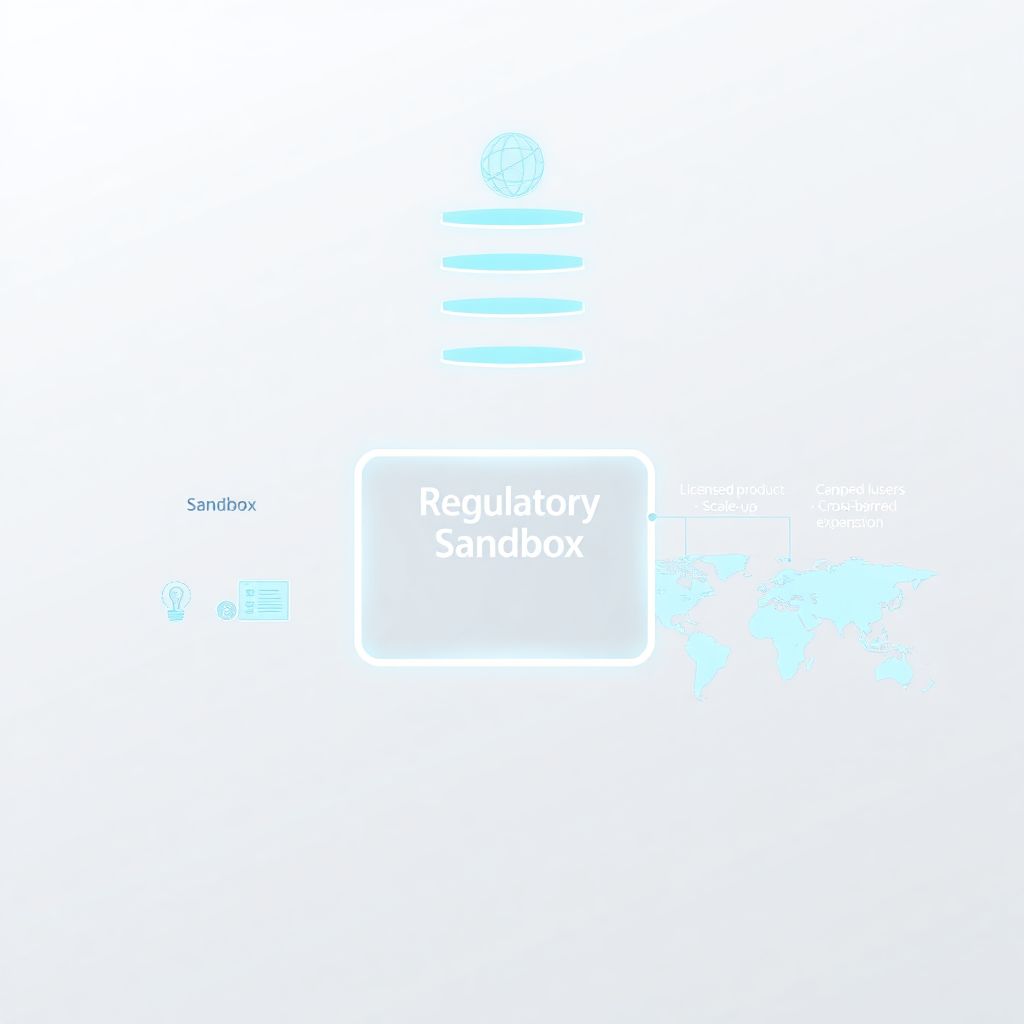

Text‑based diagram: how a sandbox fits into the lifecycle

Imagine a diagram in three horizontal layers. On the left: “Idea → Prototype → Closed testnet.” In the middle: a rectangle labeled “Regulatory sandbox,” with arrows pointing in and out. Inside it: “Limited users, capped funds, supervised experimentation.” On the right: “Licensed product → Scale‑up → Cross‑border expansion.” The arrow into the sandbox represents a blockchain regulatory sandbox application where founders pitch their model, risks, and safeguards. The arrow out represents a redesigned product, updated tokenomics and governance, plus a clearer regulatory classification. This simple flow shows why the sandbox is not a magic shield, but a bridge between hacker‑style experimentation and boring, but necessary, regulated reality.

How crypto regulatory sandbox programs usually work

Most crypto regulatory sandbox programs follow a familiar pattern. First, a call for applications with criteria: innovation, consumer benefit, and risk level. Then, a selection phase where regulators check if your idea is genuinely new and not just an excuse to bypass rules. Next comes the design of a testing plan: number of users, max transaction volume, geographical scope, and monitoring tools. During the test, you submit data and incident reports, while the regulator may allow limited marketing. At the end, there’s an evaluation: you either exit into a license path, extend the test with tweaks, or stop the project entirely if risks outweigh benefits or the model simply doesn’t work in the real world.

Sandboxes vs “move fast and break things”

Some founders see sandboxes as bureaucracy; others see them as structured de‑risking. Compare three approaches. Pure “move fast and break things” means you launch globally, hope no regulator notices, and deal with cease‑and‑desist letters later. A sandbox approach is slower at the start, but it massively reduces legal uncertainty and can make investors less nervous. A fully licensed route without a sandbox is often impossible for something genuinely novel, because the law has no clear box for it yet. The sandbox effectively becomes a negotiation room where law, technology and business models are aligned step by step, instead of colliding in court a few years down the line.

Diagram: architecture of autonomous compliance in a sandbox

Picture a layered stack diagram from bottom to top. At the base: “Blockchain layer (L1 or L2).” Above it: “Core smart contracts (tokens, lending, governance).” The next layer: “Compliance modules,” including KYC checks, jurisdiction filters, and automated transaction limits. On top: “User interfaces and APIs.” Arrows run from the compliance modules to an external bubble labeled “Regulator dashboard,” where anonymized metrics, risk alerts and threshold breaches are streamed in real time. This is how autonomous blockchain compliance solutions can turn strict legal rules into machine‑readable logic, while still allowing humans to intervene when anomalies appear. In a sandbox, you’re encouraged to build exactly this kind of “compliance by design.”

Common beginner mistakes in sandbox applications

New teams often trip at the very first step — the documentation. A classic mistake is sending a blockchain regulatory sandbox application that reads like a pitch deck for VCs instead of a risk analysis for regulators. Founders drown the file in buzzwords, but barely explain how the system handles fraud, data leaks or user refunds. Another misstep: pretending there are “no legal risks” because the project is “just technology.” Regulators instantly see that as a red flag. They expect you to identify grey zones, propose mitigations, and show you understand the bigger financial ecosystem. Ignoring that makes your project look immature, no matter how good the code is.

Technical and product mistakes inside the sandbox

Even after acceptance, beginners can sabotage themselves. Frequent issues include unstable smart contracts, rushed deployments, and poor monitoring. Teams sometimes treat the sandbox like a glorified testnet and push half‑baked upgrades directly to mainnet users, then are surprised when the supervisor questions their reliability. Another common error is changing the tokenomics mid‑experiment — for example, suddenly adding staking yields or governance rights without telling the regulator, which may flip a utility token into a security in legal terms. If you treat the sandbox plan as a flexible suggestion instead of a semi‑binding protocol, trust evaporates quickly and your exit prospects worsen dramatically.

Strategic mistakes: wrong expectations about sandboxes

Many newcomers assume that once you enter a regulatory sandbox for blockchain startups, you’re automatically “approved” forever. In reality, the sandbox is explicitly temporary and highly conditional. One widespread misunderstanding is thinking that sandbox admission equals a stamp that your token is “not a security”— regulators rarely promise that. Another mistake is using the sandbox primarily as a marketing badge: blasting press releases, hyping the “regulated” label, and luring retail users into high‑risk experiments. Supervisors watch this closely; if they feel you’re exploiting the program for PR instead of learning and adaptation, they may cut the test short or, worse, decide that your entire business culture is not license‑ready.

Best practices to actually benefit from a sandbox

To get value from crypto regulatory sandbox programs, you need to treat regulators as critical stakeholders, not final bosses to be “defeated.” A few practical habits help a lot: translate technical design into risk language; show fallbacks when automation fails; and log everything, from on-chain incidents to support tickets. Build a small internal “policy squad” that can turn regulatory feedback into concrete pull requests and parameter changes. And be candid about unknowns. Nothing annoys supervisors more than overconfident promises about “unhackable” systems. If a piece of the model is experimental, say so and wrap it in limits — user caps, loss ceilings, and kill switches that can pause contracts without nuking the entire protocol.

- Define clear testing boundaries: user caps, asset limits, jurisdictions, and eligible counterparties.

- Implement observable metrics from day one: risk dashboards, anomaly alerts, and automated reporting.

- Plan the post‑sandbox path early: which license you target and what must change to obtain it.

Designing autonomous compliance that regulators can trust

When you pitch autonomous blockchain compliance solutions, the trick is to show not only automation, but controllability. Regulators dislike black boxes, even if they’re open‑source; they need to know who is accountable when code misbehaves. So embed features like role‑based access to critical parameters, multi‑sig changes to risk thresholds, and emergency pause functions. Explain your oracle design: what happens if data feeds fail or are manipulated? Detail your audit strategy: external code reviews, bug bounties, and continuous integration checks. The more your system resembles a programmable control panel instead of a runaway robot, the more likely you are to earn trust and eventually exit into full authorization.

- Automate routine checks (sanctions screening, velocity limits) but keep humans in the loop for edge cases.

- Document every on‑chain safety valve so supervisors can trace decisions back to concrete mechanisms.

- Align incentive structures so that governance token holders don’t profit from excessive risk‑taking.

From sandbox to scale: thinking beyond the pilot

The end‑game of any regulatory sandbox for blockchain startups is not to live there forever, but to graduate with a model that works legally and commercially. This is where blockchain innovation licensing and regulatory sandbox strategies intersect: your pilot results feed directly into the license application, backed by real‑world data instead of theoretical promises. If you collect the right evidence — incident stats, user outcomes, financial flows — you can argue for tailored rules instead of being forced into outdated categories. Done well, the sandbox becomes your negotiation asset, showing that autonomous systems can be safer and more transparent than many legacy intermediaries, provided they’re engineered with regulation in mind from day zero.