Why voice suddenly matters for blockchain in 2025

From command lines to conversations

Most blockchain apps were born in a world of command lines, seed phrases and terrifyingly complex UIs. If you weren’t comfortable copying hex strings, you were basically locked out. Voice and conversational interfaces flip this model: instead of you adapting to the app, the app adapts to how you naturally talk. You say “swap 50 USDC to ETH at market, but cap slippage at one percent” and the system translates that into a safe on‑chain transaction. Under the hood nothing changes about smart contracts or signatures; what changes is the interaction layer that turns human language into strict, deterministic blockchain calls.

Definitions: voice, conversational AI and agents

When people say “voice interface” they usually mean: speech‑to‑text, natural language understanding and text‑to‑speech glued together around your app’s logic. Conversational AI is a broader term: it also covers chatbots and multi‑turn dialogues over text, where the system keeps context like “which wallet?”, “which chain?”, “which risk level?”. For blockchain apps, these pieces often wrap a small “agent” that knows your positions, gas settings, preferred chains and security rules, and then plans transactions accordingly. The result feels like talking to a human assistant who just happens to speak Solidity and JSON‑RPC behind the scenes.

Architecture of conversational AI for blockchain apps

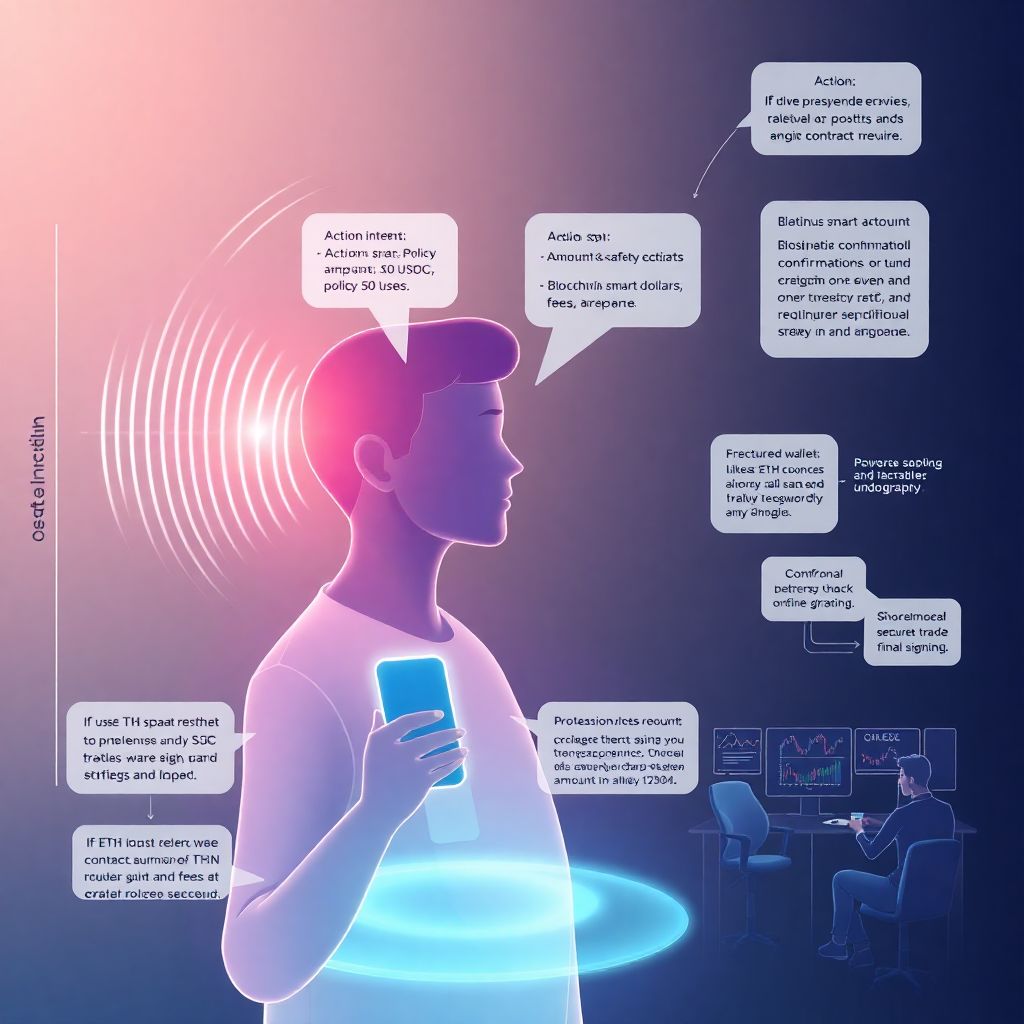

High‑level flow as a mental diagram

Imagine a diagram drawn left to right: on the far left is the user speaking into a phone; an arrow goes to a speech recognition block; from there to a natural language understanding module that outputs a structured intent like {action: “swap”, amount: “50 USDC”, chain: “Arbitrum”}. Another arrow goes to a “policy + safety” block that checks limits, approvals and suspicious contracts. Only then do we hit the blockchain connector that calls smart contracts or SDKs. The response, like “swap executed, tx hash…”, flows back through a summarizer and finally to a voice synthesizer. This pipeline is the spine of most serious implementations in 2025.

Wallets, keys and “who actually signs?”

Plugging a conversational layer into a wallet sounds simple until you ask who approves what. A voice interface for cryptocurrency wallet operations has to separate “understanding the user” from “having permission to spend funds”. Typically, the AI layer only prepares transactions and explains them in plain English: “You’re about to send 0.02 BTC to this new address, network fee is…”. Final signing stays with a secure enclave, hardware wallet or MPC system, often requiring a second factor like biometrics. This split makes it possible to talk casually to your wallet without letting a misheard command drain everything.

Use cases: from retail users to pro traders

Trading with your voice, safely

The phrase voice assistant for crypto trading used to sound like a gimmick, but in 2025 it’s becoming a real productivity tool. Retail users want something like: “If ETH drops below 2700, buy 200 dollars worth and stake it.” Power users want: “Bridge 5 ETH from mainnet to Base, then open a 3x long on ETH perpetuals if funding is below 0.03%.” The assistant parses this into multiple transactions, simulates them, and reads back a concise checklist before execution. This is where confirmation flows, limits and “teach me what this means” explanations become just as important as speed.

DeFi copilots and on‑chain analytics

An AI chatbot for DeFi platforms can sit on top of DEXs, lending pools, derivatives and yield farms, acting like a copilot rather than another dashboard. Instead of ten tabs with APR graphs, you ask: “Why is my yield lower this week?” and get a narrative answer: “Borrow rates on USDT dropped, and part of your capital is idle; I can reallocate 30% to protocol X with slightly higher risk.” Underneath, the bot queries subgraphs, block explorers and analytics APIs, but what the user experiences is a back‑and‑forth conversation that demystifies complex DeFi mechanics without dumbing them down.

How voice and chat compare to classic UIs

Strengths and trade‑offs versus forms and dashboards

Conversational interfaces shine when tasks are goal‑oriented and fuzzy: “optimize my portfolio for lower risk”, “exit positions if markets nuke while I’m asleep”. A traditional UI would force you through dozens of sliders and checkboxes; with conversational AI for blockchain apps you describe what you want and refine it through follow‑up questions. The flip side is determinism: forms make it very clear what will happen; language is ambiguous. That’s why serious systems combine both: the conversation configures the intent, then a structured, almost boring confirmation screen summarizes exact amounts, routes and fees before anything hits the chain.

Security posture compared to mobile and web

Security is the obvious concern: yelling “send everything to this address” near a noisy TV is a nightmare scenario. Compared with a mobile app, voice adds new attack surfaces: spoofed audio, kids playing with phones, manipulated prompts. However, it also brings interesting defenses. Voice biometrics can complement device auth; conversation history can be scanned for unusual patterns; the assistant can cross‑check actions with your historical risk profile. In practice, the safest setups treat voice as an initiation channel and keep a hard requirement for an independent secure confirmation, especially for large or irreversible moves.

Enterprise and pro‑grade scenarios

Trading desks and voice enabled platforms

On the institutional side, a voice enabled crypto trading platform looks more like a Bloomberg terminal with a conversational overlay than a chatty consumer app. Traders bark short commands: “Close half of the BTC perp on Bybit, move realized PnL to cold storage address 3, set TWAP over 15 minutes.” The system translates this into batched instructions across venues, runs risk checks, then reads back: “You’re closing 50% of position ID… estimated slippage is…”. Over time, these assistants learn desk‑specific jargon and macros, effectively becoming programmable through natural speech instead of proprietary scripting languages.

Back‑office automation and compliance

Outside the trading pit, conversational layers creep into accounting, reconciliation and compliance. A finance lead might ask: “Show all USDC flows from our hot wallet in the last 24 hours that exceed 50k and aren’t mapped to invoices.” The assistant doesn’t just surface rows of data; it cross‑references internal ledgers, block explorers and KYC systems. It can then offer to draft a compliance note or open a ticket. This “ask and act” workflow is especially powerful for smaller teams that can’t afford bespoke tooling, since the conversational shell can sit on top of generic block explorers and APIs.

Looking ahead: 2025–2030 predictions

From chatbots to autonomous agents

By 2030, the line between “assistant” and “agent” will blur. Today, most systems still need you to approve each transaction. In the near future, you’ll set policy boundaries—“never risk more than 2% of portfolio on a single strategy, never interact with unaudited contracts”—and the agent will act within that sandbox without asking every time. It will monitor markets, governance proposals and security alerts, then tap you only when something crosses a threshold. The human role shifts from pressing buttons to defining rules and occasionally stepping in when the model encounters a novel, high‑impact edge case.

Ambient, multimodal and chain‑agnostic experiences

Voice will also become one of several equal‑footing modalities rather than the star of the show. You’ll start a conversation with your watch while commuting, continue on a laptop with a dense chart, and confirm on a hardware wallet with a tiny screen—all part of one continuous dialogue. Underneath, chain‑specific friction will recede: instead of “switch to Polygon and approve USDC”, you’ll say “pay the developer 500 dollars” and the system will pick route, chain, bridge and token automatically. The most successful projects won’t sell “voice features”; they’ll sell the feeling that blockchain is finally invisible.