Why AI-driven scouting is suddenly a big deal for blockchain founders and investors

From hype noise to actionable signals

If you’ve ever tried to track early-stage web3 teams on Twitter, GitHub, Telegram and obscure hackathons, you know the real problem isn’t lack of information, it’s the firehose. That’s exactly where an AI innovation scouting platform for blockchain startups changes the game: instead of interns manually collecting links in spreadsheets, models continuously ingest on‑chain data, code repositories, social metrics, grant programs and even governance forums. The AI doesn’t “decide” what to invest in, but it quickly narrows thousands of weak signals to a shortlist that an analyst can actually review. Think of it as trading your binoculars for a radar system: humans still pilot the ship, but they finally see what’s coming early enough to react and negotiate on better terms.

Market stats and realistic forecasts

The numbers justify the buzz. At the peak of 2021, blockchain and crypto startups attracted over $30 billion in funding globally, then the market cooled, but the pipeline of technical founders didn’t disappear; it just became harder to evaluate through bear-market noise. According to multiple VC surveys, more than half of firms now experiment with some form of AI in sourcing and due diligence, and the share grows each year as tools mature. Over the next five years, experts expect AI-assisted scouting to become a default part of the stack, much like CRM systems did a decade ago. The practical implication: founders who understand how these systems “see” them will get into more conversations, and funds that adapt faster will quietly capture the best asymmetric bets.

How AI scouting actually works for blockchain startups

Data pipelines, models and practical examples

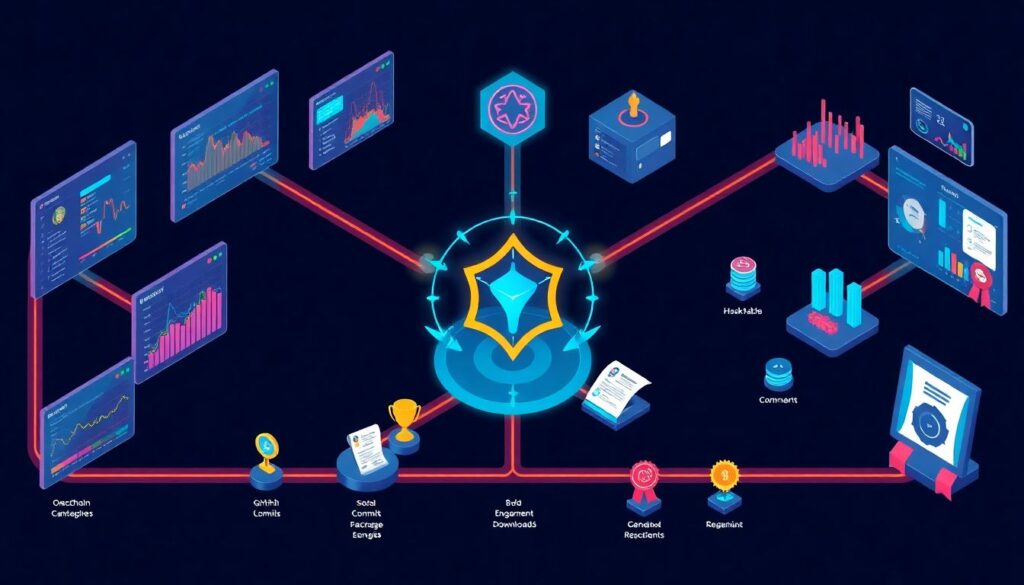

Under the hood, AI scouting is less magic and more careful plumbing. A modern blockchain startup deal flow and scouting service usually starts with wide data capture: on‑chain activity across multiple L1/L2 networks, GitHub commits, package downloads, social engagement, hackathon winners, grant recipients, even dev tooling usage. Machine learning models then look for unusual but healthy patterns: consistent code velocity, sticky community metrics, organic mentions by respected developers. For example, a small zk-rollup project with modest follower counts but intense GitHub collaboration may score higher than a loud NFT drop with paid influencers. The result isn’t a yes/no verdict but a ranked list of teams that merit a human deep dive, with explanations about which signals influenced the score.

AI tools for judging teams, tokens and traction

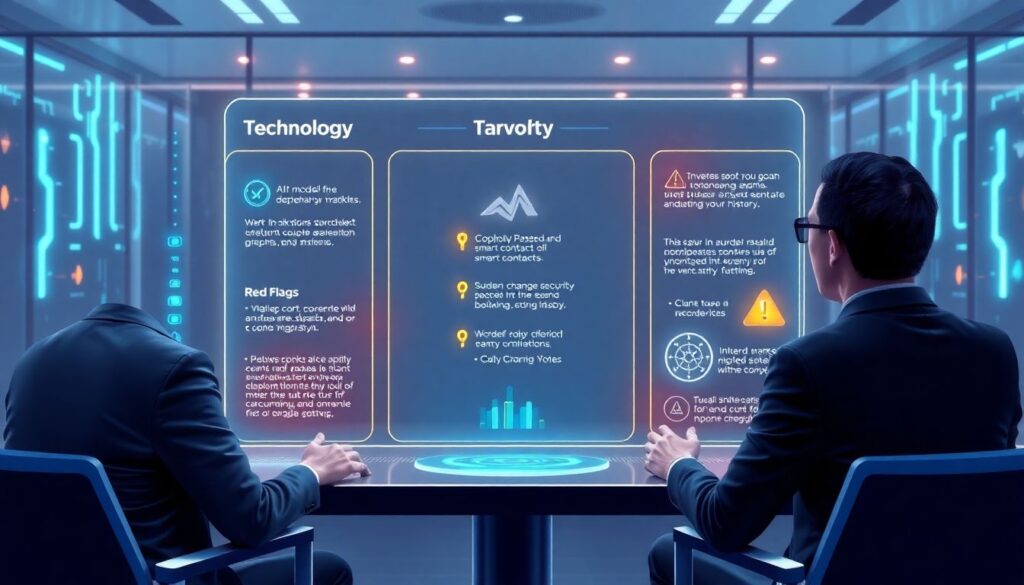

When investors talk about AI tools for identifying promising blockchain startups, they usually mean three layers of evaluation. First, technology: models analyze code quality, dependency graphs and security history to spot red flags like copy‑pasted contracts or sudden style changes that might imply outsourced or rushed work. Second, token and economic design: AI can simulate various market scenarios on proposed tokenomics, flagging unsustainable emissions or governance capture risks. Third, real traction: instead of trusting vanity metrics, systems correlate wallet behavior, retention, protocol integrations and developer reuse. One VC partner described it this way: “AI gives me an X‑ray. I still decide if the bones look investable, but I’m not guessing based on a pitch deck anymore.”

Economic impact and shifting VC workflows

From gut-feel sourcing to systematic portfolios

On the economic side, the rise of a blockchain venture capital AI-powered scouting solution quietly reshapes how portfolios are constructed. Funds that previously backed five or six deals per year can now systematically scan thousands of candidates and run scenario analysis on how each startup might perform under different regulatory, fee or liquidity environments. That doesn’t guarantee exits, but it reduces blind spots and concentration of similar bets. Experts note that AI-driven scouting especially benefits funds hunting infra and dev‑tooling plays that aren’t sexy on social media but compound value over time. For founders, this means lower chances of being ignored just because you’re not trending on X; if your on-chain and code signals are strong, you can surface to the top of an algorithmic watchlist even with a tiny marketing budget.

What experts recommend to founders and funds

Seasoned investors using startup scouting software for web3 and blockchain investors share a few very concrete tips. For founders: treat public data as your living resume. Keep repos tidy and documented, deploy contracts with clear metadata, structure governance proposals, and avoid fake engagement; AI is surprisingly good at spotting inorganic patterns. Publish roadmaps and progress updates in machine-readable formats when possible, because models can track consistency over time. For funds: resist the temptation to fully outsource thinking to the model. Use AI for triage, but enforce human investment committees, and regularly audit which features drive high scores to avoid unintentional bias, such as over-favoring developers from a few elite ecosystems or regions.

Balancing speed, risk and ethics in AI scouting

There’s also a governance angle. An aggressive AI innovation scouting platform for blockchain startups can easily drift into surveillance if misused, scraping private communities or drawing unfair conclusions from incomplete data. Expert consensus here is straightforward: limit inputs to ethically sourced and permissioned data, disclose to founders that you rely on AI-assisted scouting, and give teams a chance to correct outdated or misleading signals. Another recommendation: bake explainability into your models from day one. If your system flags a DeFi protocol as “high risk”, you should be able to point to specific factors—like admin key structure or liquidity concentration—not just a black-box score. Done right, AI doesn’t replace trust in web3; it helps both sides decide faster where that trust is worth placing.