Why smart contract optimization became a serious problem

Most teams start caring about smart contract optimization only when gas fees bite into real money or an audit flags something scary. Until then, “it compiles” feels enough. The catch: small inefficiencies in Solidity or Rust quickly snowball at scale, and traditional reviews miss patterns visible only in tons of on-chain data. That’s where smart contract optimization using machine learning quietly changes the rules, letting you look at your contracts not as static code, but as evolving systems that can be profiled, predicted and auto-tuned almost like high-frequency trading bots.

Real cases: where ML already saves gas and prevents exploits

A DeFi protocol on Ethereum noticed that users paid wildly different gas for almost identical swaps. They plugged historical transactions into a custom ML model and discovered a few innocent-looking loops that exploded gas usage under specific liquidity conditions. After refactoring based on these signals, average costs dropped ~18%. Another team used machine learning smart contract auditing to replay past hacks on forked testnets: the model flagged unusual state transitions minutes before the exploit path was obvious to auditors, giving them time to introduce rate limits and circuit breakers in production.

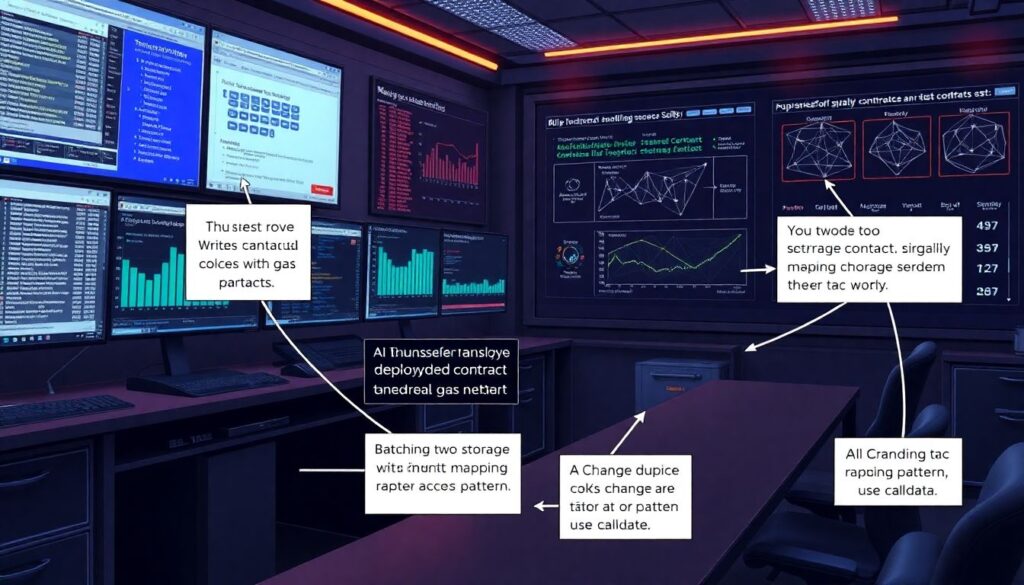

How companies quietly productize all this

Some smart contract optimization services now hook directly into CI pipelines. Every pull request triggers an ML-based analyzer that compares new bytecode against thousands of previous deployments, predicting gas cost, re-entrancy risk and storage bloat. One blockchain development company machine learning smart contracts team even built a “performance diff” bot: it comments on your PR like a nitpicky senior dev, suggesting micro-optimizations such as packing structs, replacing mappings with arrays in read-heavy paths, or reordering opcodes. The point isn’t to replace audits, but to stop wasting senior time on low-hanging fruit.

Non-obvious solutions: what ML can optimize beyond gas

When people say “optimization”, they usually mean cheaper transactions. But ML can also tune UX and economic safety. For instance, models can forecast which user actions are likely to brick a contract’s state (stuck liquidity, frozen NFTs) and preemptively warn or block them. One team trained an agent to simulate griefing strategies against their governance design, constantly probing for voting patterns that could be gamed. This is closer to “red teaming by robots” than to static review, yet it’s still a form of smart contract optimization because it hardens the system before real attackers appear.

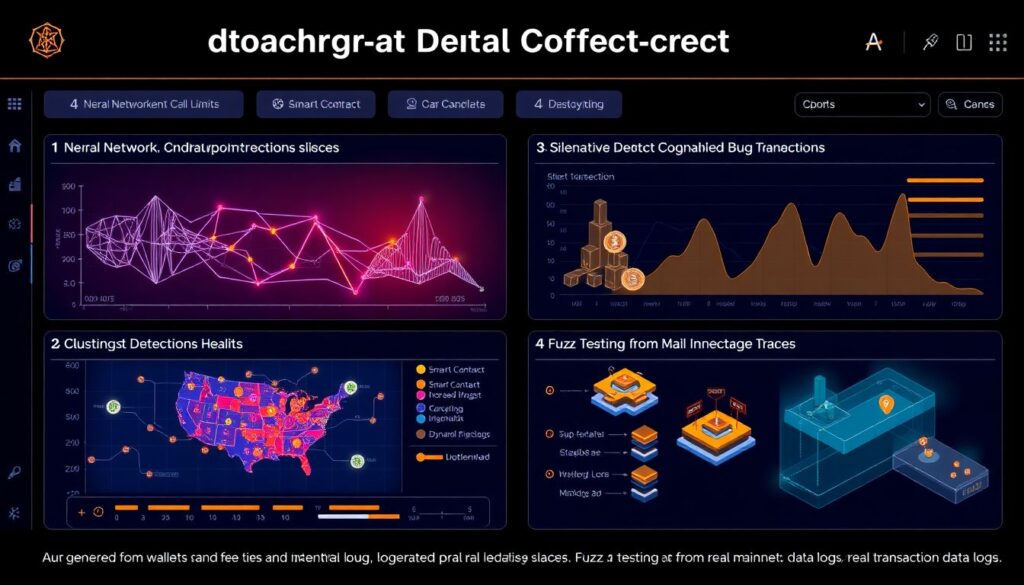

Five unconventional ML tricks for smart contracts

1. Train a model to suggest default gas limits for complex calls, reducing user failures.

2. Apply anomaly detection to function call graphs to catch silent logic bugs.

3. Use clustering on wallet behavior to tune fee tiers and incentives dynamically.

4. Auto-generate fuzzing scenarios from real mainnet data instead of random inputs.

5. Score upgrade proposals by predicted risk, not only subjective governance debates. These aren’t magic bullets, but each one solves a real pain that classic linting simply ignores.

AI-powered security: going beyond checklists

Old-school audits rely on human checklists and pattern libraries; effective, but inherently limited. New ai powered smart contract security solutions look at execution traces, mempool patterns and time-based correlations humans rarely spot. Imagine a model that tells you: “under a 20% price shock, this liquidation function will be spammed in a way that DoS-es the oracle”. You’d never find that from a quick code skim. The real power is combining symbolic tools with ML, where formal verification narrows the search space and ML prioritizes which weird scenarios are worth simulating.

Smart contract gas optimization tools with ML under the hood

A new wave of smart contract gas optimization tools doesn’t just statically analyze Solidity; they learn from thousands of deployed contracts and real gas traces. Instead of generic advice like “use calldata”, they can say: “if you batch these two writes and switch this mapping access pattern, the average user of function X will save 27% gas”. That’s the level of specificity devs actually implement. Some tools even auto-generate alternative function variants and benchmark them on testnets, giving you a ranked list of the fastest versions before you merge.

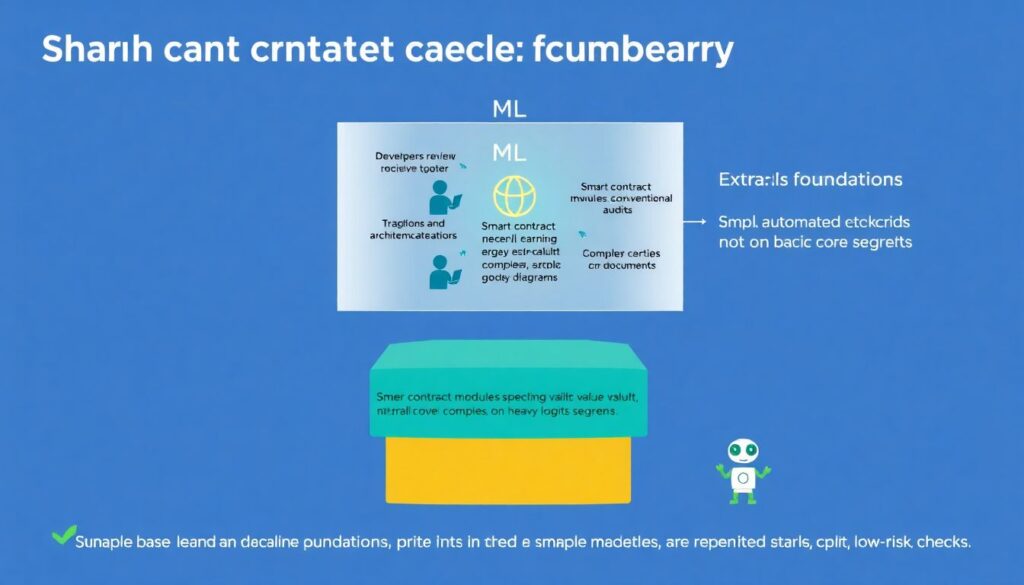

Alternative methods: when ML is not the hero

Despite the hype, you don’t need ML for every contract. Purely mathematical protocols, minimal vaults or tiny NFT drops often benefit more from strict formal verification and ultra-simple design. A clean, well-tested contract with a tiny surface area will always beat a “clever” system that leans on complex models. In some cases, the best alternative is simply rigorous gas profiling plus manual refactors. ML shines where behavior depends on messy human usage patterns or variable market conditions; for deterministic, small systems, it might just add noise and cognitive overhead.

Hybrid strategies that actually work in production

A pragmatic approach: use ML as an extra lens, not as the foundation. Start with solid patterns, peer reviews and conventional audits, then add targeted machine learning smart contract auditing for modules that handle large value, high traffic or novel logic. Let simple scripting handle routine checks, and reserve ML for the questions humans are bad at, like “how will this behave at 100x scale?” or “which edge cases are we overlooking?”. The teams that win aren’t “AI-first”, they’re “AI-when-it-matters”, plugging models into very specific choke points.

Pro tips and lifehacks for professionals

If you’re already deep in Solidity, treat ML models like any other dependency: versioned, testable and attackable. Don’t just trust a tool’s report; fuzz against its suggestions and see if they hold up on a forked mainnet. A useful hack is to log more granular custom events in staging deployments purely to feed training data later, then strip or compress them before mainnet. Another lifehack: rotate between at least two independent smart contract optimization services so their blind spots don’t overlap, a bit like using multiple compilers to flush out undefined behavior.

Where to start without drowning in buzzwords

You don’t need a PhD to benefit from this. Begin with a basic on-chain dataset: your own historical transactions, failed calls and gas profiles. Pipe that into a simple anomaly detector or clustering tool, even off-the-shelf. Next, integrate one or two reputable ai powered smart contract security solutions into your CI, just to get used to machine feedback in your workflow. Over time, you can collaborate with a specialized team or a blockchain development company machine learning smart contracts unit to build custom models tuned to your protocol’s quirks, instead of chasing generic “AI magic.”