Why DAO onboarding suddenly got complicated

DAO member onboarding used to be simple: drop a wallet, join Discord, grab some tokens. As treasuries crossed hundreds of millions and regulators woke up, this casual approach turned risky. Now DAOs try to blend openness with serious protection against sybils, bots and fraud. That’s where AI‑assisted screening comes in: it helps filter who joins, without turning a decentralized organization into a corporate HR department. The challenge is to keep the crypto‑native vibe while quietly adding structure, background checks and risk signals in the background, so legit contributors feel welcomed, not interrogated.

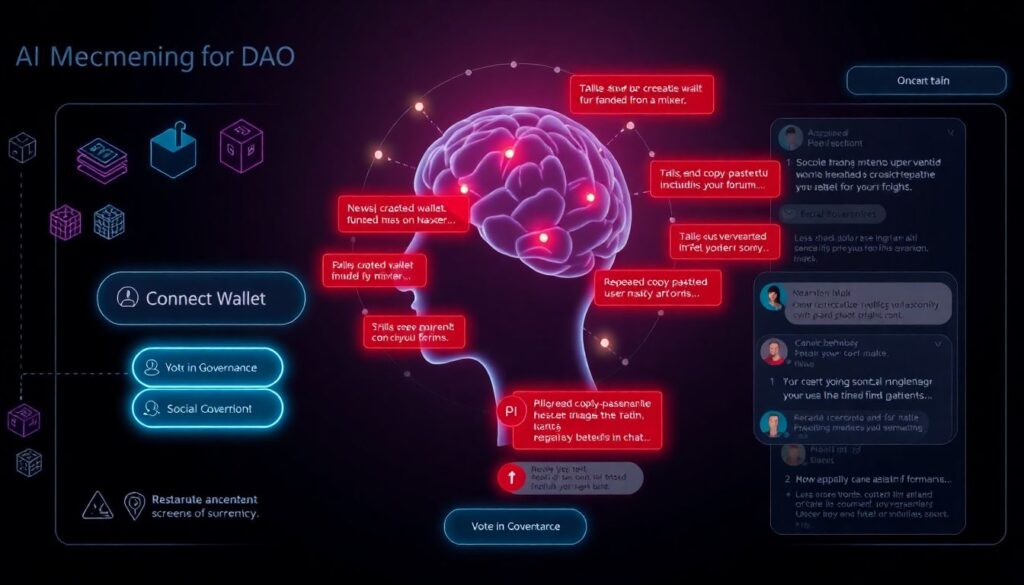

How AI-assisted screening actually works

AI screening tool for DAO membership usually sits between “connect wallet” and “vote in governance.” It ingests on‑chain data, social signals, basic KYC data (if required) and behavior patterns in chat and forums. Models look for red flags: new wallets funded from mixers, copy‑pasted bios, suspiciously synchronized voting, or accounts linked to past scams. The same tool can highlight positive markers: long‑term on‑chain activity, contribution history, GitHub repos, or verified identity. Ideally, the screening runs in seconds and outputs a risk score or membership tier, letting a DAO fine‑tune access: open for discussion, gated for treasury, stricter for multisig roles.

Numbers behind AI-driven DAO onboarding

Analysts estimate there are already over 30,000 active DAOs of very different sizes, and larger ones manage treasuries in the billions of dollars. Surveys of web3 teams show that more than half name “sybil resistance” and “spam contributors” as major pain points in growth. Early adopters of DAO onboarding software report that AI filters can cut the share of obviously fake applications by 40–70%, while keeping acceptance rates for genuine users almost unchanged. At the same time, onboarding drop‑off increases if the process feels like a traditional bank form, so UX and clear explanations matter as much as the machine‑learning magic behind the scenes.

Frequent mistakes beginners make during onboarding

Newcomers to DAOs often treat onboarding like signing up for another social network and forget that they’re entering a financial and governance system. A common mistake is using throwaway wallets with zero history, which instantly looks suspicious to any risk model. Others blindly copy generic bios or use AI to generate buzzword‑heavy intros; ironically, that’s exactly what screening algorithms flag as low‑trust. Many people also skip reading the DAO’s basic docs, then fail quizzes or alignment checks, getting mistakenly labeled as low‑engagement while they’re just unprepared and in a rush to “get in and farm.”

– Creating multiple accounts to “boost chances,” which AI correctly interprets as sybil behavior

– Ignoring requests for minimal identity proof, then complaining about “centralization”

– Overstating experience; on‑chain and GitHub history make such claims easy to verify

The safest path is to treat onboarding like a job plus a co‑op membership: be transparent, consistent across channels and patient with verification steps.

Where KYC, privacy and decentralization collide

The phrase automated KYC solution for crypto DAO sounds like a contradiction, but there is a middle ground. AI can help minimize how much raw personal data is exposed. For example, a provider verifies passport data off‑chain, issues a cryptographic proof (“I’m unique and over 18”), and the DAO only sees that proof. Screening models then combine these attestations with wallet signals, reducing fraud without turning the DAO into a data warehouse. Beginners often misread any KYC‑ish step as surrendering all privacy, when in reality good systems share far less than a centralized exchange would, using zero‑knowledge and selective disclosure instead of full document dumps.

Why governance platforms are embracing verification

As token‑based voting matures, a DAO governance platform with member verification is becoming a standard rather than an edge case. Governance attacks—buying votes, flash‑loan maneuvers, orchestrated sybil swarms—are now public case studies, not hypotheticals. Platforms respond by plugging in AI‑driven risk scores, identity attestations and reputation layers. That doesn’t eliminate token voting, but augments it: high‑risk accounts might be rate‑limited, required to stake more, or restricted from proposing high‑impact changes. For honest members, the experience hardly changes; for attackers, the cost of mischief rises dramatically, shifting the economics of governance capture.

Economic impact of better onboarding

DAO member onboarding with AI‑assisted screening has clear economic consequences. Cleaner membership reduces the share of incentives wasted on bots and low‑effort “airdrop tourists,” which can be 20–40% of campaign budgets in poorly filtered communities. With better signal‑to‑noise, grants and bounties flow to people who actually build, write and review, not just click. That, in turn, increases contributor retention and long‑term token value. Treasuries also benefit: fewer fraudulent proposals, tighter access to multisigs and risk‑weighted permissions lower the probability of catastrophic losses, which is effectively an invisible insurance policy paid for by smarter onboarding.

– Less fraud and sybil farming mean lower “leakage” of token incentives

– Higher trust encourages bigger treasury allocations and external partnerships

– Clearer roles and tiers enable more predictable budgeting for contributors

Over time, DAOs that ignore these aspects tend to underperform: constant clean‑up of scams and drama quietly erodes both runway and community morale.

Future trends: from static checks to living reputations

Today’s systems still resemble a “pass‑fail gate.” The next wave will blend AI with continuous reputation, where web3 community onboarding and identity verification are just the first step. Models will track on‑chain behavior, proposal history, code merges and even communication tone to adjust trust scores dynamically. Expect more cross‑DAO credentials: contributing well in one ecosystem will raise your standing elsewhere without redoing KYC. Forecasts from web3 infrastructure teams suggest that within 3–5 years, most large DAOs will rely on shared reputation rails instead of isolated spreadsheets and Discord roles, turning membership into a portable, composable identity layer.

How to choose DAO onboarding software wisely

When a DAO evaluates DAO onboarding software, it’s not just picking another SaaS dashboard. The key questions are: where is personal data stored, how explainable are the AI risk scores, and can the community tweak thresholds transparently? Tools should support modular verification: from pure on‑chain heuristics to strong ID checks, depending on the role. New DAOs often make the mistake of copying whatever tool a famous project uses, without matching it to their own risk profile and culture. The result is either over‑policing a tiny experimental collective or, conversely, letting a massive treasury run on vibes and unchecked wallets.

Healthy onboarding culture beats pure automation

AI can filter applications, but it cannot replace cultural onboarding: mentoring, clear guidelines and human review for edge cases. The best setups use AI screening as an assistant, not a bouncer. When newcomers understand *why* certain checks exist and how their data is handled, they’re far more willing to go through the steps. Public onboarding docs, office hours, and open discussions about verification build trust. In that environment, AI is experienced not as faceless gatekeeping, but as a quiet safety net that protects the collective from abuse—so serious contributors can focus on building instead of constantly defending the treasury.