Why smart contract verification suddenly matters a lot more

When smart contracts only moved game tokens around, bugs were annoying, but survivable. In 2025, contracts settle real estate, tokenized securities, payroll and even parts of supply-chain finance. A single integer overflow or logic slip can now vaporize hundreds of millions in a few blocks. That’s why smart contract verification using formal methods and AI is shifting from “nice to have” to “we won’t deploy without it”. Instead of just scanning code for suspicious patterns, we now try to *mathematically prove* that a contract always behaves as intended, while AI helps us scale and automate this heavy process.

Key concepts: putting names on the moving parts

Before diving deeper, it helps to align on terminology. A *smart contract* is deterministic code deployed on a blockchain, executed by the network itself. *Verification* is the process of proving (not just testing) that the code satisfies a set of properties. *Formal methods* are math-based techniques—like model checking, theorem proving and static analysis—used to reason rigorously about programs. When we say *ai based smart contract security tools*, we mean systems that use machine learning or large language models to analyze, classify and even synthesize security-relevant information about contracts.

What “formal verification” actually means in practice

In everyday development, you write tests and hope you covered enough edge cases. Formal verification flips this mindset. You start from a specification—an unambiguous description of what the contract must and must not do—and encode it in a logic that tools can understand. Then a verifier searches the entire state space (within certain bounds) to confirm that no execution trace violates your rules. The result isn’t “90% confidence” but a proof that, under the model and assumptions, the bad thing cannot happen. This is the core of blockchain smart contract formal verification platforms.

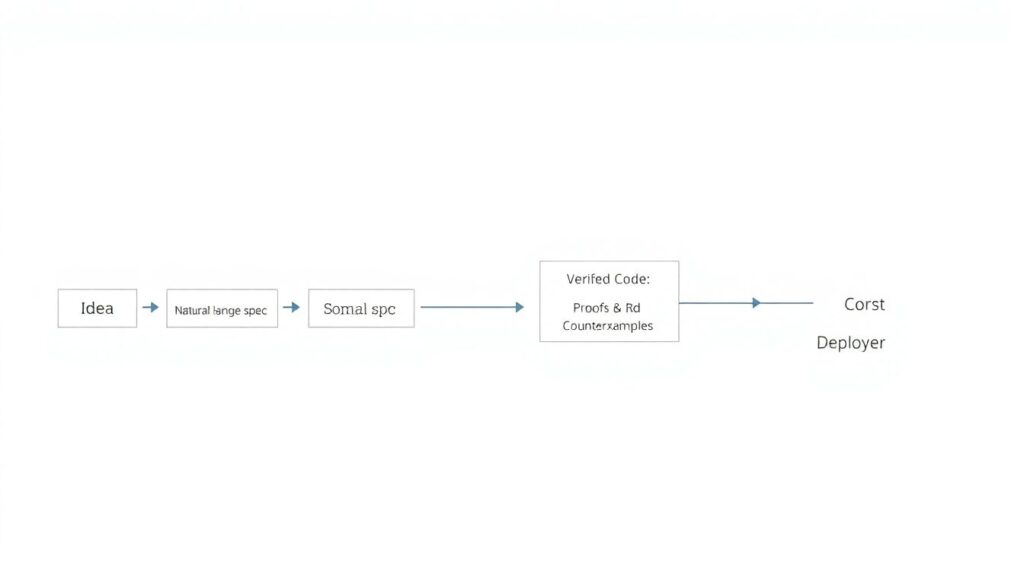

Informal diagram: from idea to proven code

Let’s outline the flow as a text diagram to keep it concrete:

`Idea -> (Natural language spec) -> (Formal spec) -> (Smart contract code)`

Then the pipeline continues:

`(Formal spec + Code) -> [Verifier / Model Checker] -> (Proofs & Counterexamples)`

Finally we end at:

`(Verified Code) -> [Deployment to Mainnet]`.

Each step either adds precision or validates previous work. The trick is minimizing semantic gaps—misunderstandings between what humans meant and what the tools actually check.

Where AI fits into the picture

AI doesn’t replace formal methods; it acts more like a turbocharged assistant that makes them usable for more teams. Today’s ai based smart contract security tools can read Solidity or Vyper, guess the developer’s intent, and propose candidate specs such as invariants (“totalSupply never decreases”) or safety rules (“no reentrancy on withdraw”). Large models can translate between informal requirements and formal annotations in languages like Scribble, WhyML or Coq-like DSLs. This reduces the main bottleneck: writing good specifications, which traditionally required rare formal-methods experts.

Diagram: AI alongside the formal toolchain

Think of the workflow as two parallel lanes:

`Developer -> Code` and `Developer -> Intent (comments, docs)`.

An AI layer sits between them:

`Intent + Code -> [AI] -> Draft formal specs / test oracles`.

Then the formal engine consumes this output:

`Code + Specs -> [Model Checker / SMT Solver] -> Verified properties`.

Feedback loops form when proofs fail; AI can explain counterexamples in human language, helping developers refine both the specs and the code more quickly.

Definitions of core verification concepts

To keep the conversation precise, a few more definitions help. A *safety property* states that nothing bad ever happens (e.g., “balances never go negative”). A *liveness property* promises that something good eventually happens (e.g., “auction eventually ends”). An *invariant* is a condition preserved by every transaction, like “sum of all account balances equals totalSupply”. *Model checking* automatically explores all states up to some bound. *Theorem proving* uses logical deduction to show that properties hold for all reachable states, often interactively with human guidance.

What smart contract verification services actually do

Professional smart contract verification services mix automation with human expertise. A typical engagement includes: manual review of architecture and threat model, static analysis, formal specification of critical components, and running protocol-specific proofs such as “no locked funds” or “no unauthorized minting”. Many providers now integrate formal methods smart contract auditing as a distinct phase, separate from regular code review. Instead of just marking lines as “looks risky”, they deliver machine-checkable artifacts—spec files, proof scripts, and verifier logs—that can be re-run whenever the code changes.

- Manual review finds design flaws and economic vulnerabilities that tools might miss.

- Automated analyzers and model checkers systematically explore code paths.

- Formal proofs give long-term guarantees, especially for protocol invariants.

Comparing approaches: testing, audits, formal methods, AI

Let’s compare the major lines of defense. Unit tests and fuzzing are quick and intuitive, but they’re inherently incomplete; they can show the presence of bugs, not their absence. Manual audits bring specialized knowledge, but humans get tired and miss edge cases. Formal methods, when applied correctly, offer exhaustive guarantees within their model, yet they require expertise and careful setup. AI-based approaches excel at scale and pattern recognition but can hallucinate or mis-rank risks. That’s why a professional smart contract audit using formal methods and AI tends to blend all four, rather than betting on a single technique.

Realistic example: verifying a token with vesting

Consider a token contract that includes vesting schedules for team members. Naive testing might check a few timelines and balances; a simple bug in time arithmetic could still slip through. With formal verification, you would express properties like: “Before cliff time, vestedAmount(account, t) = 0”, “After end time, vestedAmount equals total allocation”, and “Transfers never exceed vestedAmount”. A model checker then proves these for all possible blocks and user actions. AI tools can help derive these formal properties from onboarding docs or comments, making the process feel closer to enhanced testing than to abstract math.

Blockchain smart contract formal verification platforms in 2025

By 2025, we have a whole ecosystem of blockchain smart contract formal verification platforms targeting EVM, WASM and bespoke chains. Many platforms provide intermediate representations that look like simplified bytecode, which is easier to reason about than raw Solidity. On top of this IR, vendors add domain-specific logics for DeFi, NFTs, or cross-chain bridges. CI/CD integration has become standard: pushes to main branches trigger full property checks for critical modules, not just linting. This brings formal checks closer to the developer’s everyday workflow, similar to how unit tests moved into pre-merge pipelines years ago.

How AI changes developer ergonomics

The biggest usability win from AI is that it reduces the “formality tax”. In the past, writing specifications felt like learning a new programming language plus a bit of logic. Now, developers can describe behavior in normal English and let AI propose candidate specs, then tweak them. Tools highlight suspicious flows—like reentrancy, price-oracle misuse or unexpected token approvals—and explain them conversationally. Instead of reading dense SMT logs, you might see “If attacker calls function X after changing poolPrice, they can withdraw more than they deposited”. This makes formal reports readable by non-academic engineers.

- AI assists with generating and refining invariants and pre/post-conditions.

- Models cluster similar vulnerabilities across large codebases for pattern discovery.

- Natural-language explanations shorten the feedback loop from proof to fix.

Trade-offs and limitations you should be aware of

Despite the hype, none of this is magic. Formal proofs are only as strong as the specifications and models they’re based on. If your spec neglects economic assumptions—like “oracles remain honest”—tools cannot save you from oracle manipulation. AI can suggest properties, but it can also misinterpret protocol intent, especially in novel DeFi mechanisms. High-assurance proofs can still be expensive for very complex protocols. Finally, integrating these methods into a fast-paced startup pipeline requires discipline: versioning specs, treating proofs as build artifacts and budgeting time for iteration when properties fail.

How to decide which level of rigor you need

Risk-driven choices work best. For low-value, experimental dApps, automated scans plus a lightweight audit might be enough. Once you hold user deposits or issue widely traded tokens, you should at least verify invariants like “no unauthorized mint” and “no permanent fund lockups” with formal tools. For base-layer bridges, rollup contracts and core DeFi primitives, a full formal-methods pass with AI assistance is quickly becoming the norm. Organizations often start by using ai based smart contract security tools internally, then bring in external smart contract verification services for their most sensitive components.

Practical tips for teams starting in 2025

If you’re getting into this now, treat specifications as first-class artifacts. Capture requirements—economic constraints, governance rules, failure modes—in a structured format from day one. Choose a language or framework supported by at least one mature verifier; you want to stand on existing tooling, not build your own theorem prover. Hook the verifier into your CI pipeline early, even if you initially check only a few basic properties. Experiment with commercial and open-source tools; many blockchain smart contract formal verification platforms offer free tiers for smaller projects, which is perfect for learning without large upfront cost.

Forecast: what will change by 2030

Looking ahead, expect verification to blend invisibly into development. IDEs will propose formal specs as you code, much like autocomplete, backed by both AI and learned templates from thousands of audited projects. Regulatory pressure will likely require higher tiers of assurance for financial and identity-related contracts; auditors will have to show evidence of formal methods smart contract auditing for systemically important protocols. We will probably see shared, community-maintained libraries of proven components—escrow, vesting, upgradeability proxies—where users rely on existing machine-checked proofs rather than reinventing the wheel each time.

Closing perspective

Smart contract verification using formal methods and AI is moving from niche research to everyday engineering practice. The combination gives you something unique: mathematically backed guarantees at human-usable cost and speed. In 2025, the projects that survive aren’t the ones that ship fastest, but those that avoid catastrophic failures while still iterating. By investing in tooling, adopting AI assistants thoughtfully and demanding more from your professional smart contract audit using formal methods, you’re effectively buying resilience for your protocol—and, in a very real sense, for the users who trust it with their assets.