Category: Cryptocurrencies & Finance

-

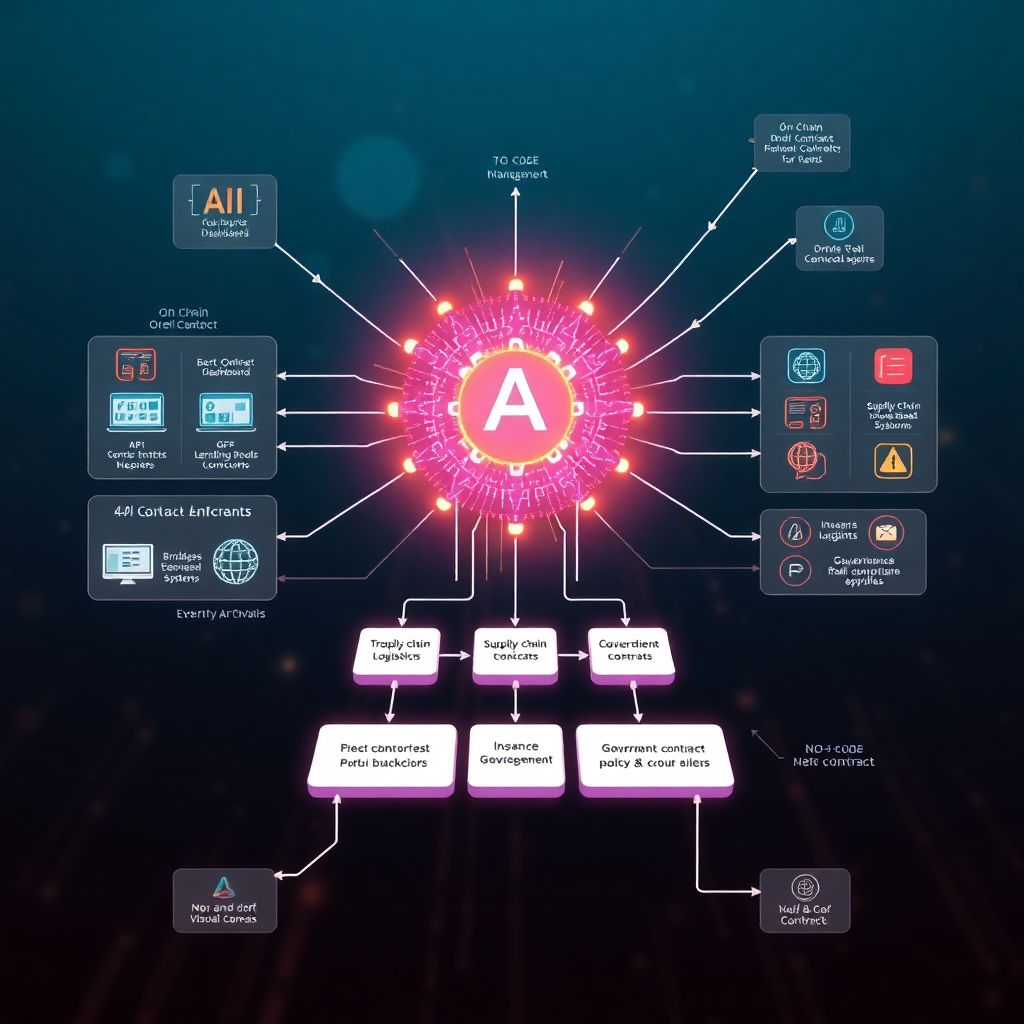

Smart contract orchestration with ai-driven workflows for automated blockchain apps

Historical background: how we got to AI‑driven orchestration From manual ops to programmable agreements Smart contracts have been around since the 1990s as an idea, but only really took off after Ethereum launched in 2015 and turned them into executable code on a public blockchain. For several years teams mostly focused on writing individual contracts…

-

Ai-powered risk-aware investment strategies in highly volatile markets

Understanding AI-powered risk-aware investing in wild markets Why volatility is both a threat and an opportunity When markets swing hard, prices stop reflecting calm fundamentals and start reflecting raw emotion. That’s where AI-powered risk-aware investment shines: models can scan thousands of assets, measure how risk is clustering, и highlight setups that humans simply overlook. Instead…

-

Crypto tax automation using Ai and blockchain for accurate, effortless reporting

Historical context of crypto tax automation In the early days of Bitcoin, nobody seriously thought about taxes; most traders kept rough spreadsheets and hoped tax authorities would ignore this strange new asset class. As volumes grew and regulators in the US, EU and Asia issued clearer guidance, manual reporting quickly turned into a nightmare: thousands…

-

Impact investing in blockchain-enabled autonomous systems and future innovations

Impact investing in blockchain-enabled autonomous systems sounds a bit like sci‑fi finance, but на практике это довольно приземлённая история: вы вкладываете деньги в проекты, где автономные алгоритмы и блокчейн решают реальные социальные и экологические задачи, а не просто гоняют токены по кругу. Такие проекты могут управлять распределённой солнечной энергетикой, оптимизировать логистику с меньшим CO₂ или…

-

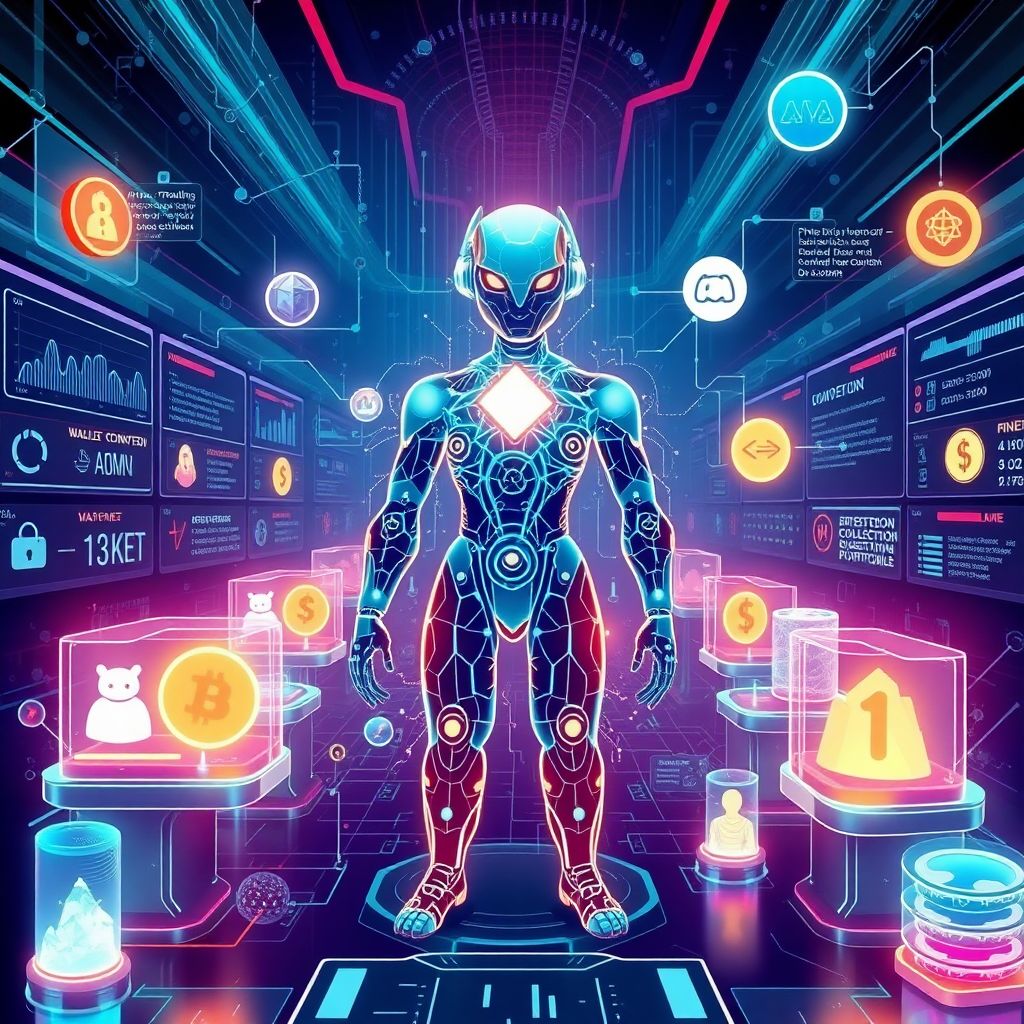

Ai-assisted fraud prevention in Nft markets: how smart tools protect traders

Why AI is becoming the backbone of safe NFT markets If you’ve watched the NFT space for more than a week, you know it’s a wild mix of brilliant innovation and outright chaos. Collections explode overnight, anonymous wallets move millions, and then—suddenly—everyone on Twitter is yelling about a rug pull or a hacked Discord. In…

-

Blockchain-enabled digital rights management with Ai for secure content protection

Why DRM needs blockchain and AI in 2025 By 2025 медиарынок окончательно уехал в подписки и стриминг, а старые DRM выглядят как замки из тонкой фольги. Файлы легко копируются, отчётность по роялти туманная, а споры об авторстве всплывают каждый месяц. Поэтому на сцену выходят blockchain digital rights management solutions, где права, лицензии и доходы фиксируются…

-

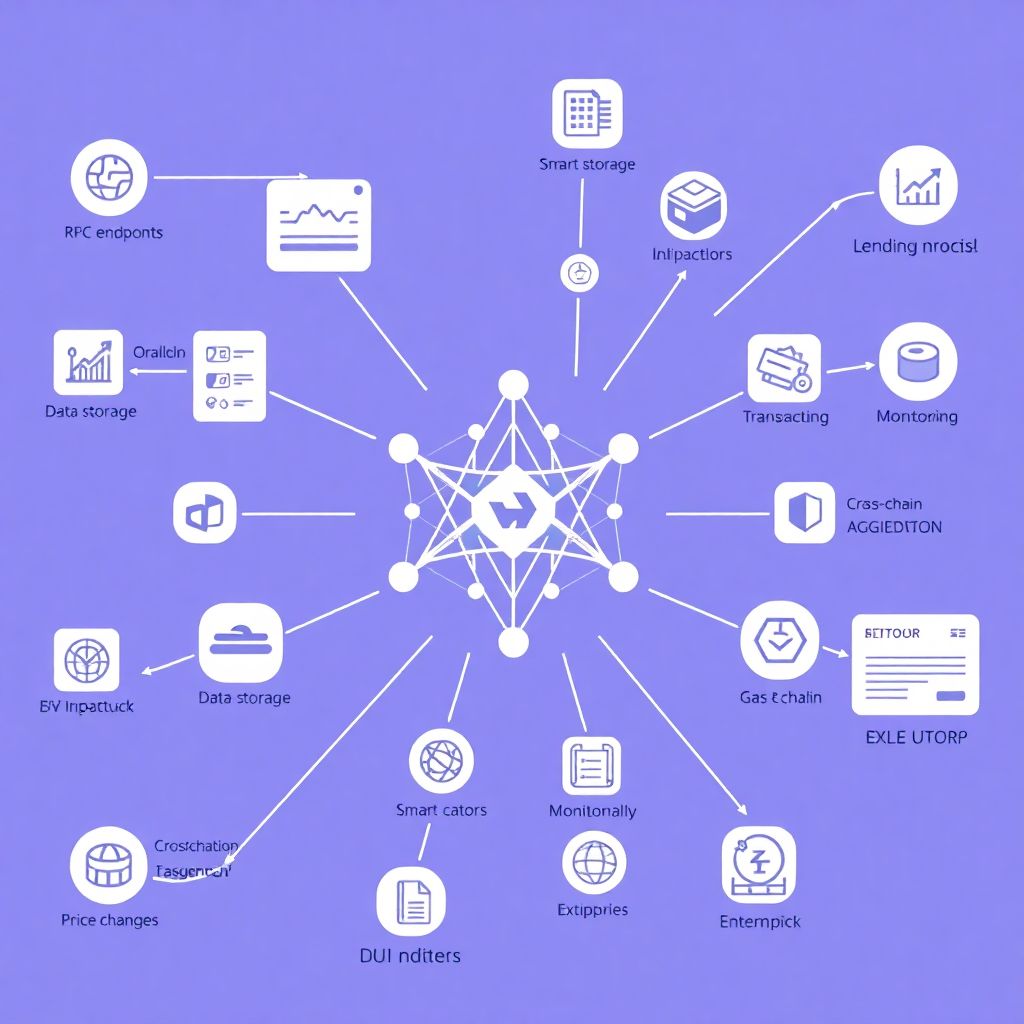

Decentralized finance infrastructure and autonomous orchestration for scalable defi

Why DeFi Infrastructure And Orchestration Matter Right Now Decentralized finance звучит как нечто абстрактное, пока вы не пытаетесь запустить хотя бы простой продукт: кошелек, лендинговый сервис или протокол стейкинга. В этот момент выясняется, что вам нужна не просто идея, а нормальная decentralized finance infrastructure platform, которая не падает при первом же всплеске трафика и не…

-

Ai-driven financial forecasting for crypto markets: boosting trading accuracy

How AI-Driven Forecasting Emerged in Crypto Markets AI in finance isn’t new, but in crypto it went through a compressed evolution. Around 2016–2018, most “smart” tools were basically rule-based bots reacting to simple indicators like RSI or moving averages. They didn’t really learn; they just executed scripts faster than a human. The real shift started…

-

Autonomous trading bots and market making on decentralized exchanges explained

Why autonomous trading bots took over DeFi (and what “market making” really is) When people talk about “autonomous trading bots” on decentralized exchanges, they usually mix together three вещи: execution bots (they just send trades), arbitrage bots (they hunt price gaps), and market-making bots (they continuously quote buy/sell prices to earn the spread and fees)….

-

Autonomous asset management on decentralized platforms: how it works and evolves

Why autonomous asset management in DeFi is getting real Manual DeFi felt fun, пока суммы были небольшими и протоколы можно было пересчитать по пальцам. Но когда у вас 15–20 позиций в разных сетях, стейкинг, фарминг, лендинг и хеджирующие позиции через деривативы, все превращается в работу на полный день. На этом фоне автономные системы, которые сами…